SimpleSwap Staking: The Way To Earning Crypto Rewards

In the ever-evolving world of cryptocurrency, SimpleSwap staking has emerged as a powerful strategy for investors seeking to earn passive income without the complexities of active trading. Whether you're a beginner dipping your toes into DeFi or a seasoned holder looking to maximize yields, understanding how to stake on SimpleSwap can transform your portfolio. This comprehensive guide dives deep into what is staking, the step-by-step process for staking crypto on SimpleSwap, future perspectives on SimpleSwap staking, and potential drawbacks to consider. Optimized for those searching for reliable SimpleSwap io staking rewards, we'll cover everything you need to know to get started today.

What is Staking?

Staking represents a cornerstone of Proof-of-Stake (PoS) blockchain networks, where users lock up their cryptocurrency holdings to support network operations and, in return, earn rewards. At its core, staking is like putting your crypto to work: instead of letting assets sit idle in a wallet, you delegate them to validators who secure the blockchain through consensus mechanisms. This process validates transactions, prevents double-spending, and maintains network integrity—much like mining in Proof-of-Work systems, but far more energy-efficient.

When you engage in SimpleSwap staking, you're tapping into a user-friendly platform that simplifies this process. SimpleSwap, renowned for its instant swaps without mandatory registration, extends its non-custodial ethos to staking services. Here, SimpleSwap staking allows you to stake popular assets like Ethereum (ETH), Cardano (ADA), Solana (SOL), and more, earning Annual Percentage Yields (APY) that can range from 5% to over 20%, depending on the token and market conditions.

Unlike traditional staking on exchanges that might require KYC verification or long lock-up periods, SimpleSwap staking emphasizes flexibility. You retain control over your private keys, reducing counterparty risks, while the platform's intuitive interface makes it accessible for newcomers. Rewards are typically distributed automatically—often daily or weekly—compounding your earnings over time. For instance, staking 10 ETH at a 6% APY could net you an additional 0.6 ETH annually, all while contributing to the blockchain's decentralization.

In essence, staking on SimpleSwap democratizes passive income, blending security, simplicity, and profitability. It's not just an investment tool; it's a way to align your financial goals with the broader crypto ecosystem's growth.

How to Stake Crypto on SimpleSwap

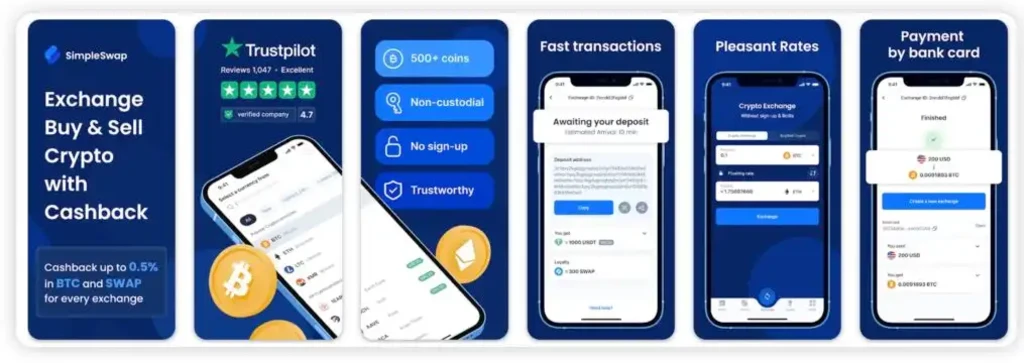

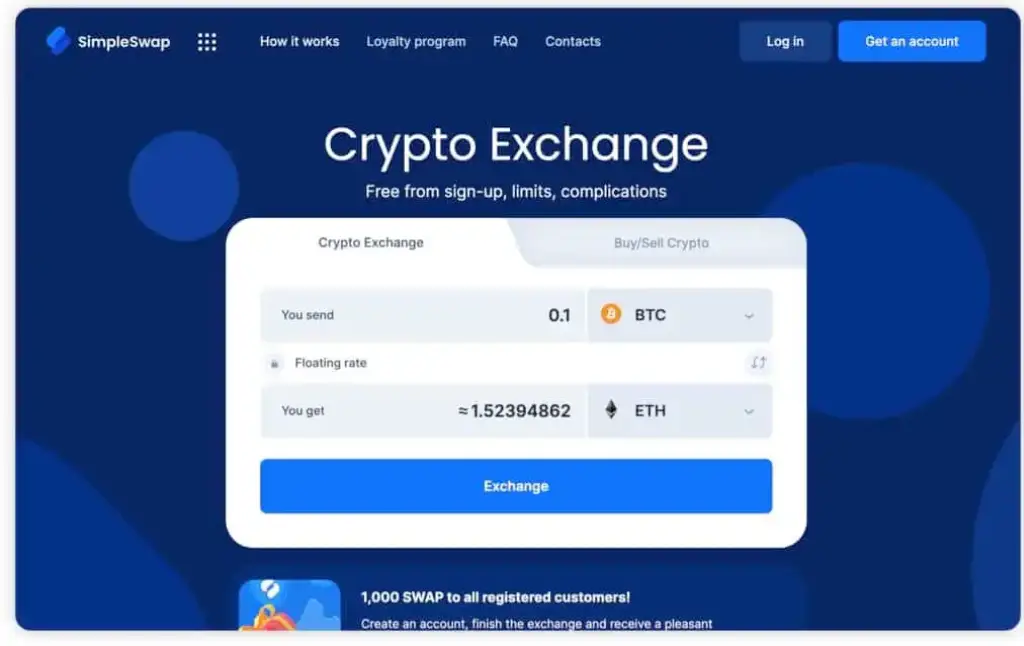

Getting started with staking crypto on SimpleSwap is straightforward, designed for efficiency without unnecessary hurdles. Whether you're using the web app or mobile version, the process takes mere minutes. Below, we'll break it down into actionable steps, ensuring you can begin earning SimpleSwap staking rewards with confidence.

- Set Up Your SimpleSwap Account: Head to the official SimpleSwap io website and navigate to the staking section—no account creation or KYC required for basic use. If you prefer enhanced features like portfolio tracking, optional registration via email or wallet connection (e.g., MetaMask) is available. Fund your wallet with the desired staking asset using SimpleSwap's swap tool for seamless conversions from fiat or other cryptos.

- Choose Your Staking Asset: SimpleSwap supports a diverse array of stakeable tokens, including ETH 2.0, DOT (Polkadot), ATOM (Cosmos), and emerging gems like TON (The Open Network). Review the live APY dashboard, which updates in real-time based on network participation. Factors like token utility and validator performance influence yields—aim for assets with proven ecosystems for stable returns.

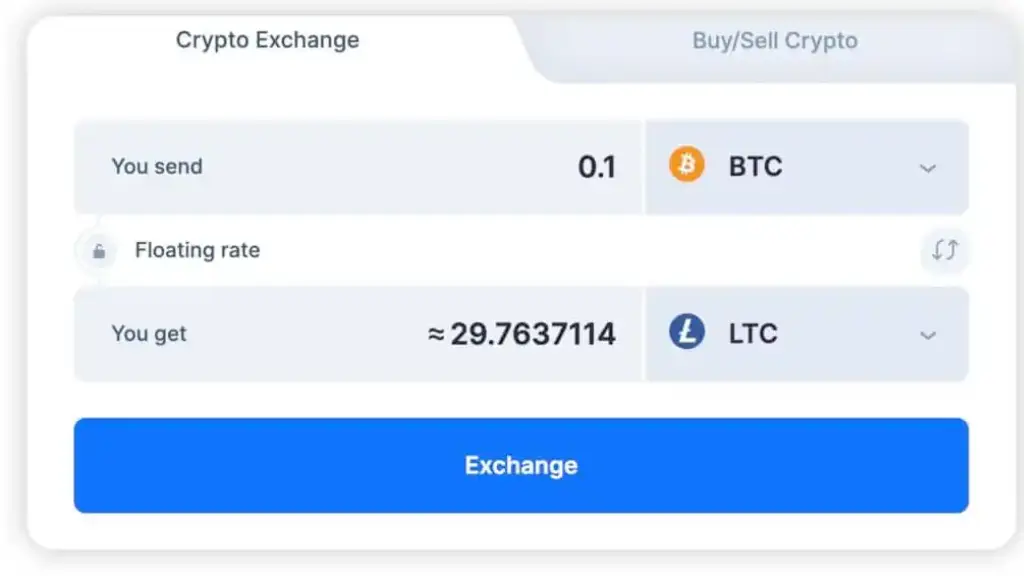

- Initiate the Stake: Select your token, input the amount to stake (minimums vary, often as low as 0.1 ETH), and choose a flexible or fixed-term option. Flexible staking allows anytime withdrawals with minor penalties, ideal for liquidity needs, while fixed terms (e.g., 30-90 days) boost APYs. Confirm the transaction via your connected wallet—gas fees apply on the respective blockchain, but SimpleSwap estimates them upfront for transparency.

- Monitor and Claim Rewards: Once staked, your assets are locked securely on-chain. Track progress through SimpleSwap's dashboard, which displays accrued rewards, total staked value, and performance analytics. Rewards auto-compound in many pools, but you can manually claim them to reinvest or withdraw. Unstaking is equally simple: request via the platform, wait for the unbonding period (e.g., 21 days for Cosmos), and funds return to your wallet.

Pro Tip: For optimal how to stake crypto on SimpleSwap, diversify across 3-5 assets to mitigate risks from single-network volatility. As of 2025, SimpleSwap's staking volume has surged 150% year-over-year, reflecting growing trust in its non-custodial model.

By following these steps, you'll unlock SimpleSwap staking benefits like compounded growth and network participation, all without advanced technical know-how.

Perspectives on SimpleSwap Staking

Looking ahead, the perspectives on SimpleSwap staking are overwhelmingly positive, fueled by blockchain's maturation and regulatory tailwinds. As PoS networks dominate—projected to handle 70% of transaction volume by 2027—platforms like SimpleSwap io are poised for exponential growth. With integrations for Layer-2 solutions (e.g., Optimism, Arbitrum) and cross-chain bridges, SimpleSwap io staking will likely expand to yield farming hybrids, offering APYs up to 30% on DeFi tokens.

From an investor's viewpoint, SimpleSwap staking perspectives shine in a post-halving era where Bitcoin's scarcity amplifies altcoin rewards. Analysts forecast average staking yields stabilizing at 8-12% through 2030, outpacing traditional savings by 10x. SimpleSwap's commitment to zero-fee staking (beyond network costs) and AI-driven yield optimization tools could capture 15% market share in non-custodial staking by 2026.

Environmentally, staking's low-energy footprint aligns with global ESG trends, attracting institutional capital. Imagine staking green cryptos like Algorand (ALGO) on SimpleSwap, earning while supporting carbon-neutral blockchains. Challenges like scalability will be met with upgrades like Ethereum's Dencun, enhancing SimpleSwap io staking efficiency.

Overall, the horizon for staking on SimpleSwap is bright: more tokens, higher liquidity, and seamless mobile experiences, making it a staple for long-term HODLers.

Drawbacks of SimpleSwap Staking

No investment is without risks, and drawbacks of SimpleSwap staking deserve honest scrutiny to inform balanced decisions. Chief among them is lock-up periods: While flexible options exist, many high-yield pools require 7-28 day unbonding, tying up capital during market dips and potentially leading to opportunity costs if prices surge.

Volatility remains a universal crypto pitfall—SimpleSwap staking rewards can fluctuate with token prices, eroding real returns. For example, a 10% APY on a 20% depreciating asset nets a net loss. Slashing risks, though rare (under 0.1% on vetted networks), occur if validators misbehave, penalizing stakers proportionally.

Platform-specific cons include dependency on wallet security: As non-custodial, SimpleSwap can't recover lost keys, emphasizing user responsibility for hardware wallets. Gas fees, especially on Ethereum, can nibble at small stakes, and while APYs are competitive, they lag behind centralized platforms like Binance for ultra-high yields (with added custody risks).

Regulatory uncertainty looms—evolving U.S. and EU rules could impose taxes on SimpleSwap staking rewards or limit access, impacting global adoption. Finally, for beginners, the learning curve around on-chain transactions might deter, despite SimpleSwap's simplicity.

Mitigate these by starting small, diversifying, and staying informed. When weighed against upsides, SimpleSwap staking drawbacks are manageable for informed users, solidifying its role as a smart, low-barrier entry to crypto yields.

Ready to stake? Visit SimpleSwap io today and start earning. For more on SimpleSwap staking, follow their updates on X or join community forums.